Bitcoin: The Genius of Satoshi

Every four years in the history of the premiere crypto asset Bitcoin (BTC), crypto traders the world over wait with bated breath for its most anticipated event — the ‘Bitcoin Halving’ (more on that later).

With that happening in a matter of hours, it is time to take a look at this controversial, volatile, yet top-performing currency which relies solely on technology without the need for a central bank or other intermediaries.

Response to the economic crisis

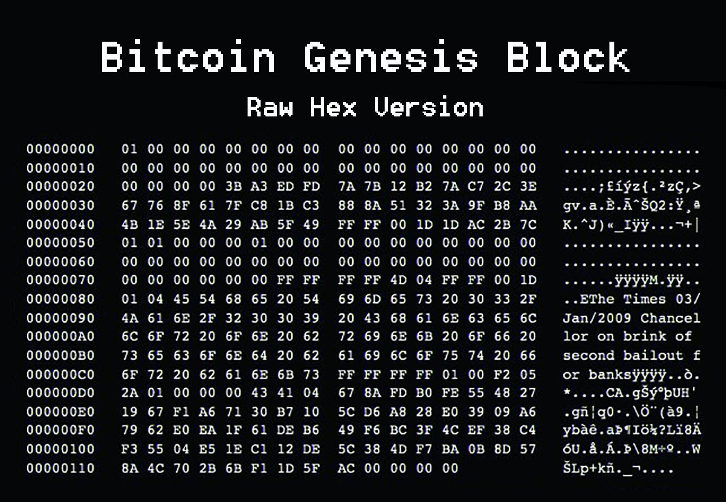

In January 2009, in the words of Bitcoin’s mystery inventor Satoshi Nakamoto, the bitcoin network was launched “on the brink of [a] second bailout for banks.”

Believed to be an individual or a group operating under the pseudonym ‘Satoshi Nakamoto’, the identity of Bitcoin’s founder has been shrouded in secrecy from the outset, no doubt adding fuel to Bitcoin’s already controversial mission of offering an alternative economic system.

The then newly-formed digital currency was seen as an indictment of the global financial crisis of 2008 and the fractional reserve banking system used by the world’s banks. Designed as a peer-to-peer electronic cash system, Bitcoin transactions are maintained on a system of decentralized network nodes through cryptography and recorded on a public blockchain (distributed ledger).

Decentralized, immutable and secure by design

For those who find the concept daunting, simply put, each Bitcoin transaction (e.g. X transfers 0.01 BTC to Y) is data that is recorded on a growing list of records called ‘blocks’. Each block contains transaction data, timestamps and a cryptographic hash of the previous block. With each block of data chained to the next block (blockchain), a verifiable ledger of transactions can be permanently recorded.

Collectively managed by a peer-to-peer network, the Bitcoin blockchain is designed to resist data modification. Once recorded on the blockchain, the data on any block is immutable without altering all subsequent blocks. Only by consensus of the network majority can alteration happen, which, because of the decentralized nature of the global P2P network of computers or nodes, is difficult to secure. Hence, blockchains are considered secure by design.

Inbuilt inflation controls

Nodes that use mining devices to locate new blocks (of recorded data) on the BTC blockchain are rewarded with new Bitcoins. In 2009, that block reward was worth 50 BTC. After every 210,000 block transactions, which happens approximately every four years, that reward is halved.

Hence in 2012, the first Bitcoin halving took place with its formulated reduction to 25 BTC reward per block of transactions; and again in 2016 where it was further reduced to 12.5 BTC; the third and current halving reduces the block reward to 6.25 BTC.

BTC halving acts as an inbuilt mechanism to control inflation. A total of 32 halvings have been programmed to take place, with the last and final halving producing a block reward of 1 Satoshi (0.00000001 BTC).

Bitcoin halving, together with the pre-defined algorithm cap that limits the issuance of BTC at 21 million coins, guarantees the scarcity of Bitcoin. As the Bitcoin network expands over the years, the underlying blockchain software ensures that BTC production continues at a controlled and steady pace.

Trust the code

Arguably blockchain technology’s most significant use case, Bitcoin’s unique properties allow for novel and exciting uses that previous payment systems could not.

With no central bank, government or single entity responsible for transactions, Bitcoin continues to run its community-driven transactions autonomously and successfully.

What is important to note is that amidst the current COVID-19 pandemic, the BTC and cryptocurrency markets have not needed external interventions the way traditional markets have. The monetary easing policies and economic bailouts across the world are raising eyebrows over the viability of fiat currencies.

It can be argued that investors from traditional finance have instead begun to hedge against volatility in traditional markets by turning to BTC as a ‘store of value’, evidenced by the influx of institutional money.

While not without flaws, Bitcoin and the cryptocurrencies it has spawned over the past ten-plus years represent viable alternative economic systems. Bitcoin’s mission of shifting economic control and power over to the hands of individuals and communities continues to challenge monetary monopolies. Aside from the price of Bitcoin, the other question currently a-buzzing in the cryptosphere is whether the COVID-19-induced financial fallout might be the linchpin that finally triggers cryptocurrency mass adoption.

Photo credit: iStockphoto/whyframestudio